made

for a happy day

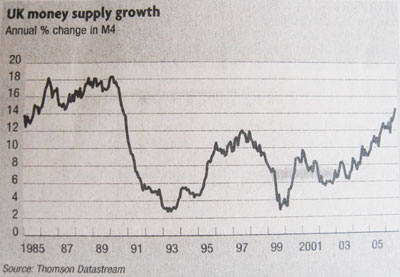

Too much money (UK 2006)

The western world is awash with money in search of a decent return. In fact, the west has so much money that 'investors' surely no longer take much interest in start-ups or new products or nurturing potential, so addicted are we to laying bets on this or that going up or down. It's a game of bluff, sometimes called casino capitalism.*1

Part of the reason for the current glut of money must be to do with the fact that so much of it is now just digits on a statement, electronic transfers of binary code, backed up not by something hard to produce - like precious metals - but solely by the bank or government's word. Of course, such assurances are cheap. The US sells bond after bond whilst running up the size of 'overdraught' it would tolerate of no other oountry, save perhaps Britain.

Fortunately for the US, developing nations have a lot of confidence in the probability that buying US government bonds (effectively IOUs promising interest) is their best defense against speculative attacks on their own currencies and enterprises. Other countries buy dollars because they are given no other option. All middle eastern energy sales are, by US decree, made only for dollars.

And then came the Euro. Let's see what happened when Saddam declared that he would sell his oil in Euros. Let's speculate whether the US is more worried about Iran having nuclear energy or whether it is more concerned about Iran's stated plan to open an oil bourse where oil will sell in Euros.

But I digress...

The current money glut is compounded by the rules under which UK and US

banks operate. For every deposit a bank receives, it is entitled to create

new money - specifically a loan of up to 90% of the value of the deposit.

A loan goes out, repayments come back in the form of deposits, and further

loans can be made as a result. By the time this chain reaction has fizzled,

the bank may have been able to issue 9 times the monetary value of the

intitial deposit in credit loans.

You may have gathered that banks lend a lot more money than they actually possess at any given time. This is digital money - it lives in the ether gathering interest (real money) for the banks whilst, in reality, being unavailable in real cash terms to the savers that earned it. Bank branches have hardly any cash. Pop in and ask for £5000 from your savings account and you'll most likely be asked to come back tomorrow. In times of crisis, tomorrow may never come (ask an Argentinian on this).

So, you'll notice, the idea that banks keep our money safe is a myth. They don't. In fact, they immediately lend our savings to other people, mainly in the form of mortgages which tie those people to 25 years of repayments. Banks and building societies are not transparent on the questions that really matter. Few are going to question the prudence in you taking out a massive loan provided you have a home to secure the loan, a good income, and have shown no signs of being a bad risk in the past. None are going to remind you that around two thirds of the mortgage is going not on bricks and mortar, but on the grotesquely inflated price of the land beneath your home - a price inflated by the banks willingness to offer larger and larger mortgages even as the house price bubble balloons and interest rates rise.

All the collective power of the media persuades us to borrow to invest in the next surefire profit-making wheez. But only a tiny minority of players win - as any lottery player will tell you.

It is interesting that so little of the wealth washing around the UK appears to have been earned through productive labour within the UK. Virtually all manufactured products are now made elsewhere. We are now a 'services' nation. We service each other but produce hardly anything. We have priced ourselves out of the market of sustainable production... such is our thirst for profit.

Arguably, our basic consumer ideals have been met. As a result, it is getting harder for investors to find something tangible to invest in which has not yet been offered to the western consumer many times over. Our high street shops have become out of town warehouses in order to accomodate the farcical excess of choice that is the range of butters and magarines on the modern superkmarket shelf. Our investor 'dragons' increasingly sit tight on their cash, mirroring our company's inertia with respect to reinvesting profits. We used to invest in the future. It could be a sign of universal uncertainty about the next 50 years that long term investment plans appear to have been put on hold.

The glut of pounds and dollars could, of course, be used to do some real good. It could be sparking up a million and one enterprises in the developing world and tackling all the major natural threats to human survival. But, the western monetary system would rather keep us busy spending and borrowing at home. Money-laundering regulations, shifting currency values and poor bank transfer services are all there to put off would-be small investors who would be enthusiastic about African development.

So, did we all work unbelievably long and hard to generate all this money? Are the banks lending too much? Is some of the liquidity finding its way into the economy coming from undeclared sources beyond the realms of acceptable dinner table discussion.

Something is certain, with the amount

loaned in mortgages during August 2006 clocking up more pound signs

than the amount loaned in 1988 (just before the UK housing crash of 1989),

a serious adjustment might not be far away. The banks have seemingly endless

amounts of money (oil

profits?) to lend right now, but the behaviour

of big business signals that right now isnt' the best time for would-be

homeowners to be borrowing it.

*1. Graph shows annual foreign exchange transactions in millions (2% real

vs 98% speculative) - see Bernard Lietaer's The

Future of Money.

Ends | 22 Sep 2006 | The Leg

post a comment | back to top | thoughts

Essential Reading:

The

Grip of Death by Michael Rowbotham

The

Future of Money by Bernard Lietaer

Related Articles:

2013

Where

credit is due - A short history of loans

2012

JP

Morgan reveal losses of $4.4bn frrom London trading losses

'London

Whale's bad bet loses JPMorgan $2bn

2011

UBS Trader Kweku Adoboli held over suspected $2bn loss

BoA

$8.5bn settlement over misleading reselling of mortgages

Era

of cheap capital drawing to a close?

2010

WikiLeak:

Sudanese president stashed £9bn in London banks?

2009

$350bn

of drugs money was laundered via banks during crisis?

US

Treasury Secretary dismisses Tobin Tax idea as unworkable

Iranian

Oil Bourse (trading in euros) inaugurated

Move

underway to use euros rather than dollars for oil trading?

In

2005, Iceland ranked in the world's top 10 for GDP per head

2008

The

UK - a nation of consumers who miss making stuff?

Parallel derivatives betting

starving real world of cash?

2007 - to June

Prices

soar as super rich invade London art market

Oil

money boosts London home prices

Savings

glut, money glut - what risks happening as a result?

Wave

of oil money hits UK

2006:

Mortages fuel surge in supply of money

City

to pay out record £8.8bn in bonuses

The

blunders of boom and bust

US

economy on thin ice say ex-US Federal Reserve Chair

|

|

Graph: Oct 06 - FT reports that money supply is growing

at its fastest annual rate in 16 years.